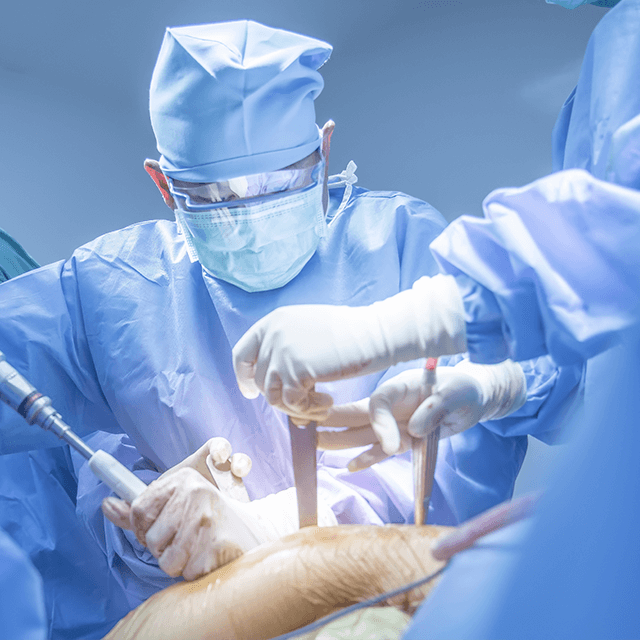

Trauma insurance provides a lump sum payment upon the diagnosis of critical illnesses according Trauma insurance policy terms and conditions and typically includes cover for around 50 conditions, including heart attacks, cancer, strokes etc.

Yamini Agrawal, the Head of Insurance at Global Finance, highlights the value of trauma insurance. She states, “Trauma insurance is one of the most-claimed insurance cover. It can ease financial pressures and provide financial support to help cover loss of income, medical expenses, debts, and rehabilitation costs associated with critical illnesses.”

With a serious medical diagnosis, your ability to work and your income may be severely impacted. That’s when trauma insurance steps in so you can focus on your health without worrying about financial obligations. “You can focus on treatment and recovery, knowing that your family is financially supported through trauma insurance claim amount ” explains Yamini Agrawal, Head of Insurance at Global Finance.

You can spend the lump-sum payment as you see fit. Whether you use it for medical expenses, mortgage payments, travel costs, home modifications to accommodate your health condition, or hiring someone to help with household tasks, the choice is entirely yours.

Basic trauma insurance and hybrid cover

In New Zealand, two main types of trauma insurance are available: basic and continuous or progressive. Basic trauma insurance offers coverage for a predetermined amount and is the cheaper option, but it has some limitations. For example, if you make a claim for an illness like cancer under basic trauma insurance, you’ll face a 12-month waiting period before your coverage is reinstated. And possibly even more importantly, you may not be eligible to claim for a similar condition again. This means that if the cancer returns, you probably won’t be able to make another claim.

Continuous/ progressive trauma insurance provides more extensive coverage and one of its significant advantages is that you can make multiple claims, even for the same health issue.

“With continuous/ progressive trauma insurance, you can reinstate your coverage immediately after making a claim, and you’ll still be protected for the same illness, depending on the policy’s wording and your eligibility,” Yamini explains. Continuous/ progressive trauma insurance allows you to claim your full coverage amount up to three to four times. This can be particularly valuable as people can experience serious illnesses multiple times. Having the option for more payouts can literally be a life-changer.

Financial help when you need it most.

Despite its broader coverage, however, Yamini highlights that continuous/ progressive trauma insurance in New Zealand is only slightly more expensive than basic trauma insurance.

Getting the right insurance advice

Yamini Agrawal stresses the importance of working with a qualified and an experienced insurance advisor. Trying to successfully navigate the various trauma insurance policies available from different insurance companies can be overwhelming. With help from an expert in trauma insurance, you will find the right policy to fit your needs and budget. An insurance broker can ensure you understand the various policy options, triggers, conditions covered, waiting periods and exclusions if any of each policy. We will make sure you know what is covered and what isn’t.

Tips for successful trauma insurance claims

Next, we asked Yamini Agrawal for her expert insights into the best way to make sure trauma claims get approved. Here is her advice:

Understand Your Policy: Familiarise yourself with the terms and conditions of your trauma insurance policy. For a claim to be accepted, the nature of the trauma must match what is described in the policy wording. Trauma insurance, for example, covers certain specified life-threatening health conditions, such as defined cancers and heart attacks, but does not include traumatic events. You need to be aware of policy exclusions and limitations that may apply to each condition covered under your policy. Reading policy documents and seeking clarification from your insurance adviser will help you to fully understand your eligibility.

Insurance providers may also impose waiting periods on certain medical conditions meaning claims are not payable should symptoms present within certain time frames.

“This is why we strongly recommend you to please see the qualified and experienced insurance adviser about trauma insurance,” Yamini explains.

Full Disclosure: Honesty is everything when it comes to trauma or any insurance. The acceptance of any claim depends on being diagnosed with a condition covered under your policy and meeting the terms specified in it. You must provide your insurer with full details of your medical history. Be completely transparent when applying and provide up-to-date medical and personal information. Do not guess or omit information. Doing so could lead to your claim being denied.

Document Everything: Keep detailed records of policy documents, correspondence with the insurer, and any relevant medical evidence. Having relevant documentation will help speed up the claim process.

Promptly Notify the Insurer: In the case of a covered medical event, inform our advisors immediately and we’ll get the claim process underway as soon as possible. Delaying the notification can lead to unnecessary complications and delays in receiving the trauma claim.

Provide Complete Medical Records: Submit all necessary medical records and documentation and throughout the claim process, be cooperative and responsive to any requests for additional information.

What to do when your trauma claim is declined?

In the case of a declined trauma claim, you have the right to have the decision reviewed. Having an expert on your side to advocate on your behalf, communicate directly with your insurance company and support and guide you through the appeals process will make a world of difference. We have cases where initially insurer declined trauma claim but upon making appeal, claim was reviewed and paid by the insurance company.

Understanding the intricacies of trauma insurance policies can be challenging.

Partnering with an experienced broker who specialises in trauma insurance can make a huge difference. We have in-depth knowledge of the various policy triggers, exclusions, and options. We also know how to manage successful claims.

As Yamini Agrawal says, “Insurance is a specialist field requiring extensive knowledge and experience. As good insurance advisers, it’s our job to work together with you to provide guidance and quality advice.”

If you need help finding the right trauma insurance policy, reach out to qualified insurance advisers like Yamini Agrawal and her team at Global Finance on 09 2555500 or insurance@globalfinance.co.nz .They can guide you through the process and tailor a plan to suit your needs.

The information and articles published are true to the best of the Global Finance Services Ltd knowledge. Since the information provided in this blog is of general nature and is not intended to be personalized financial advice. We encourage you to seek Financial advice which is personalized depending on your needs, goals, and circumstances before making any financial decision. No person or persons who rely directly or indirectly upon information contained in this article may hold Global Financial Services Ltd or its employees liable.